Apr 11, 2022

Why do You Need Public Adjuster? You Wish You Knew Before

Homeowners, condominium complexes, and businesses that suffer property damage or loss may find themselves in a very stressful situation at the time of their insurance loss, as a major property insurance loss may have a crippling impact on the usual running of your company or personal life at home.

Even the most efficient business or family might be overwhelmed by the expectations and demands put on them during the time of your bereavement.

Corporate executives, commercial property owners, and homeowners usually lack the information and expertise necessary to prepare for a complicated claim, and in most situations, they lack the time.

This is when a public adjuster might come in handy.

This is when a public adjuster might come in handy.

The Benefits of Using a Public Adjuster.

The Benefits of Using a Public Adjuster Managing the formalities for submitting a property damage claim with your insurance company adds to the uncertainties and key choices that must be made. Insurance companies and their claims representatives may seek comprehensive information that seems excessive but is important.

Understanding what your policy covers and what your responsibilities are might get complicated depending on the information provided by an insurance carrier’s adjuster.

A thorough investigation and documenting of the loss are necessary, which includes using all available investigative and valuation knowledge to determine the property’s pre-loss state. Today, like with other things, this procedure has gotten extremely complicated.

When you have property damage, the insurance company will send either a staff adjuster hired by the insurer or an independent claims adjuster contracted by the carrier.

Depending on the circumstances, they may also be compensated depending on the volume of claims handled or the speed with which a claim is settled. Regardless, you should recognize that both the insurance company’s personnel and independent claims adjuster represent and serve the insurance company’s best interests.

A public adjuster on the other hand works for you, the policyholder, to ensure that your best interests are protected and that the insurance company pays your claim fairly and follows the terms of your policy.

Here are a few of the biggest advantages of hiring a public adjuster.

The Benefits of Using a Public Adjuster Managing the formalities for submitting a property damage claim with your insurance company adds to the uncertainties and key choices that must be made. Insurance companies and their claims representatives may seek comprehensive information that seems excessive but is important.

Understanding what your policy covers and what your responsibilities are might get complicated depending on the information provided by an insurance carrier’s adjuster.

A thorough investigation and documenting of the loss are necessary, which includes using all available investigative and valuation knowledge to determine the property’s pre-loss state. Today, like with other things, this procedure has gotten extremely complicated.

When you have property damage, the insurance company will send either a staff adjuster hired by the insurer or an independent claims adjuster contracted by the carrier.

Depending on the circumstances, they may also be compensated depending on the volume of claims handled or the speed with which a claim is settled. Regardless, you should recognize that both the insurance company’s personnel and independent claims adjuster represent and serve the insurance company’s best interests.

A public adjuster on the other hand works for you, the policyholder, to ensure that your best interests are protected and that the insurance company pays your claim fairly and follows the terms of your policy.

Here are a few of the biggest advantages of hiring a public adjuster.

1. Time Savings

Many homeowners and business owners have more vital concerns than dealing with the insurance company’s constant requests for information and documentation. A public adjuster will arrange and handle your claim, reducing the amount of time you must spend dealing with all of the claim difficulties.

2. Expertise in Claims

Insurance policies may be complicated documents that are readily misunderstood. Having someone on your side who understands both the text of the insurance policy and how those provisions are implemented may make a significant difference in how your claim is resolved.

It also helps to have an expert guide you through the right processes for repairs and recording expenditures in the event of claim rejection.

3. Faster Claim Resolution

Knowing how to prepare your claim, file the necessary documentation, and use the correct terminology when speaking with your insurance carrier will assist prevent repeated requests for further information, accelerate the claims process, and get your repairs going faster.

4. Protect Your Rights

If your claim is rejected, having a skilled public adjuster who knows the insurance company’s expectations while documenting and valuing your claim will offer you an edge. It also provides you with a third-party resource who may serve as a witness if more aggressive action is necessary to get a fair recovery.

5. Ensure Fair Value for Your Claim

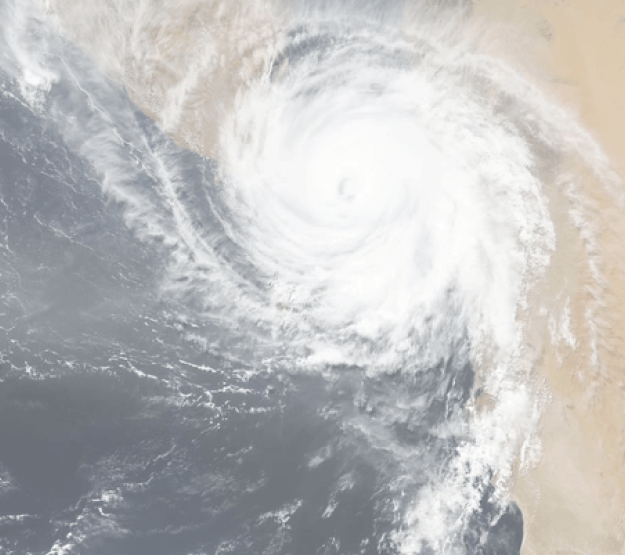

Public adjusters can negotiate a higher payout for commercial business and homeowner insurance property loss claims than the insurance company was planning to payout. This is particularly true after a disaster when insurance companies must handle a huge number of claims.

Bottom Line

When everything is said and done, employing a public adjuster makes both practical and economical sense. ICA Public Adjuster’s solid reputation, great list of customer references, history in the business, and strong client service dedication all contribute to the result of a favorable claim. We hope now you know everything about public adjusters. Who are public adjusters, what do they do, when do you need them, and most importantly why do you need them.

Many homeowners and business owners have more vital concerns than dealing with the insurance company’s constant requests for information and documentation. A public adjuster will arrange and handle your claim, reducing the amount of time you must spend dealing with all of the claim difficulties.

2. Expertise in Claims

Insurance policies may be complicated documents that are readily misunderstood. Having someone on your side who understands both the text of the insurance policy and how those provisions are implemented may make a significant difference in how your claim is resolved.

It also helps to have an expert guide you through the right processes for repairs and recording expenditures in the event of claim rejection.

3. Faster Claim Resolution

Knowing how to prepare your claim, file the necessary documentation, and use the correct terminology when speaking with your insurance carrier will assist prevent repeated requests for further information, accelerate the claims process, and get your repairs going faster.

4. Protect Your Rights

If your claim is rejected, having a skilled public adjuster who knows the insurance company’s expectations while documenting and valuing your claim will offer you an edge. It also provides you with a third-party resource who may serve as a witness if more aggressive action is necessary to get a fair recovery.

5. Ensure Fair Value for Your Claim

Public adjusters can negotiate a higher payout for commercial business and homeowner insurance property loss claims than the insurance company was planning to payout. This is particularly true after a disaster when insurance companies must handle a huge number of claims.

Bottom Line

When everything is said and done, employing a public adjuster makes both practical and economical sense. ICA Public Adjuster’s solid reputation, great list of customer references, history in the business, and strong client service dedication all contribute to the result of a favorable claim. We hope now you know everything about public adjusters. Who are public adjusters, what do they do, when do you need them, and most importantly why do you need them.

RELATED ARTICLES

How to Get Insurance Claims Approved for Roof Damage

September 8, 2022

It’s that season

July 22, 2022

Why Did I Receive a Non-Renewal?

June 13, 2022