Apr 22, 2022

What Damages Does a Public Adjuster Handle?

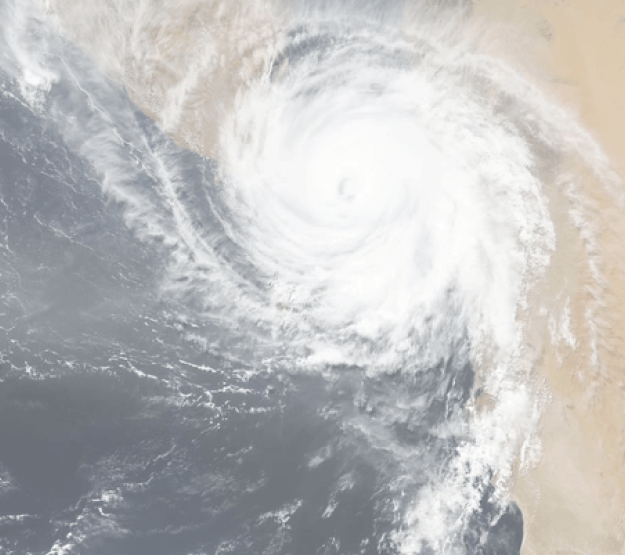

Public adjusters may submit and settle claims for flood, fire, smoke, wind, and hurricane damage, as well as damage from other risks. Property damages may result in other sorts of losses, such as lost company revenue, which public adjusters can assess.

In return for a fee, public adjusters analyze property losses on behalf of policyholders and assist them in filing insurance claims. They are registered experts that work for people and businesses rather than insurance companies and may save you a lot of money by ensuring your insurance company pays the exact amount it is obligated to pay under your policy.

In return for a fee, public adjusters analyze property losses on behalf of policyholders and assist them in filing insurance claims. They are registered experts that work for people and businesses rather than insurance companies and may save you a lot of money by ensuring your insurance company pays the exact amount it is obligated to pay under your policy.

What is the Job of a Public Adjuster?

The only property loss experts that operate on behalf of policyholders are public adjusters. Individuals and corporations use public adjusters when they require help filing a claim or believe an insurance company’s claim amount is inaccurate.

What Does A Public Adjuster Do For You?

Public adjusters are specialists in insurance policy details and terminology, as well as in submitting and adjusting claims. They often have past expertise in construction or a similar sector, and they employ sophisticated technologies to undertake an unbiased review of a client’s property damage. They understand how to track and submit original and additional claims on behalf of a policyholder.

They also assist customers in negotiating with contractors and their insurance companies. Having an adjuster throughout the process not only protects the policyholder from any hazards caused by inexperience, but it is also a time-demanding procedure that the adjuster will labor over.

Should I Hire a Public Adjuster?

Anyone thinking about submitting a property insurance claim should also consider employing a public adjuster, particularly if the claim is large. You have little to lose as a policyholder: Many public adjustment businesses will come to a property loss free of charge to assist a policyholder in determining the extent of damage and whether or not to make an insurance claim.

Even if a policyholder is certain of the monetary worth of their property damage, it is prudent to get a second opinion on an expensive occurrence such as a house insurance claim. When adjusters visit a house or company, they often discover that their damage estimate is significantly below what it should be.

Public adjusters are experts, and it is unlikely that they would exclude expenditures from their estimates that a policyholder may forget or be unaware of.

For example, if a section of a roof is destroyed by wind, a homeowner runs the danger of underestimating the cost of a new roof and failing to account for the cost of replacing the damaged roof completely.

It is essential to submit an accurate, complete claim to get the appropriate amount of money from an insurance provider to cover property damage.

Remember that even the greatest homes insurance providers will never pay more than the amount claimed. Policyholders must verify that they are claiming the right amount, and engaging a public adjuster may assist with this.

The only property loss experts that operate on behalf of policyholders are public adjusters. Individuals and corporations use public adjusters when they require help filing a claim or believe an insurance company’s claim amount is inaccurate.

What Does A Public Adjuster Do For You?

Public adjusters are specialists in insurance policy details and terminology, as well as in submitting and adjusting claims. They often have past expertise in construction or a similar sector, and they employ sophisticated technologies to undertake an unbiased review of a client’s property damage. They understand how to track and submit original and additional claims on behalf of a policyholder.

They also assist customers in negotiating with contractors and their insurance companies. Having an adjuster throughout the process not only protects the policyholder from any hazards caused by inexperience, but it is also a time-demanding procedure that the adjuster will labor over.

Should I Hire a Public Adjuster?

Anyone thinking about submitting a property insurance claim should also consider employing a public adjuster, particularly if the claim is large. You have little to lose as a policyholder: Many public adjustment businesses will come to a property loss free of charge to assist a policyholder in determining the extent of damage and whether or not to make an insurance claim.

Even if a policyholder is certain of the monetary worth of their property damage, it is prudent to get a second opinion on an expensive occurrence such as a house insurance claim. When adjusters visit a house or company, they often discover that their damage estimate is significantly below what it should be.

Public adjusters are experts, and it is unlikely that they would exclude expenditures from their estimates that a policyholder may forget or be unaware of.

For example, if a section of a roof is destroyed by wind, a homeowner runs the danger of underestimating the cost of a new roof and failing to account for the cost of replacing the damaged roof completely.

It is essential to submit an accurate, complete claim to get the appropriate amount of money from an insurance provider to cover property damage.

Remember that even the greatest homes insurance providers will never pay more than the amount claimed. Policyholders must verify that they are claiming the right amount, and engaging a public adjuster may assist with this.

How Much Does it Cost to Hire a Public Adjuster?

Many public adjusters do not charge a fee to visit a damage site and evaluate if they would deal with a policyholder on a case.

A public adjuster will often charge a percentage of whatever a policyholder’s insurance company eventually pays for a claim. Assume a policyholder pays a 10% fee to an adjuster and their insurance company finally pays $100,000 for their claim. The insured would then be obligated to pay the public adjuster $10,000.

The proportion of the charge varies by the adjuster and is typically regulated by municipal or state legislation. Fees, for example, cannot exceed 20% of a reopened or supplementary claim limit in the state of Florida. There is also a 10% fee cap for claims originating from an incident declared a state of emergency by Florida’s governor.

Public adjusters are similarly limited in the amount of money they may charge each claim. In general, public adjusters with less expertise may set a fee ceiling of $5,000 per claim. Experienced adjusters may charge substantially greater rates, such as $10,000 or $15,000.

For example, a public adjuster may charge a fee of $15,000 for a $350,000 claim instead of their standard 20% fee of $70,000. They may also negotiate a reduced percentage charge for major claims, such as $1 million or more in property damages.

Confused about whether should you hire a public adjuster or not? Get a FREE inspection and virtual consultation from us NOW at IC Adjusters.

Many public adjusters do not charge a fee to visit a damage site and evaluate if they would deal with a policyholder on a case.

A public adjuster will often charge a percentage of whatever a policyholder’s insurance company eventually pays for a claim. Assume a policyholder pays a 10% fee to an adjuster and their insurance company finally pays $100,000 for their claim. The insured would then be obligated to pay the public adjuster $10,000.

The proportion of the charge varies by the adjuster and is typically regulated by municipal or state legislation. Fees, for example, cannot exceed 20% of a reopened or supplementary claim limit in the state of Florida. There is also a 10% fee cap for claims originating from an incident declared a state of emergency by Florida’s governor.

Public adjusters are similarly limited in the amount of money they may charge each claim. In general, public adjusters with less expertise may set a fee ceiling of $5,000 per claim. Experienced adjusters may charge substantially greater rates, such as $10,000 or $15,000.

For example, a public adjuster may charge a fee of $15,000 for a $350,000 claim instead of their standard 20% fee of $70,000. They may also negotiate a reduced percentage charge for major claims, such as $1 million or more in property damages.

Confused about whether should you hire a public adjuster or not? Get a FREE inspection and virtual consultation from us NOW at IC Adjusters.

RELATED ARTICLES

How to Get Insurance Claims Approved for Roof Damage

September 8, 2022

It’s that season

July 22, 2022

Why Did I Receive a Non-Renewal?

June 13, 2022