May 10, 2022

How to Get Insurance Claims Approved for Roof Damage

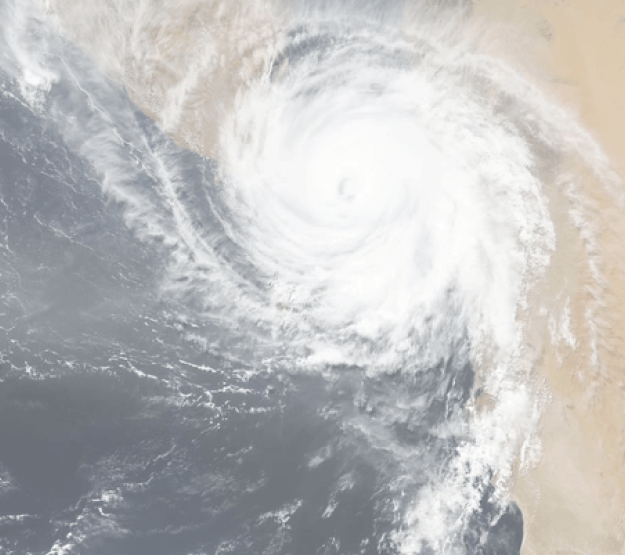

Roofs are continuously under assault from weather and elements, from falling trees to hail storms and severe winds. Most property owners are unaware of roof damage until it becomes such a major issue that it causes other difficulties, such as interior damage from leaking water.

Failure to be proactive after a wind or hailstorm might result in roof damage claims being denied. In this post, we will go through how to react to roof damage, file an insurance claim, deal with a public adjuster, and handle roof inspections.

How Roof Damage Claim Procedure Works

Insurance companies have a vested interest in denying roof damage claims. Unfortunately, their first focus is not always taking care of their policyholders and repairing property losses to pre-loss state. The following is how a policyholder should handle a roof damage insurance claim, as well as what can happen in the best-case scenario.

Procedures for Filing and Obtaining Approval for Roof Repairs

1). A storm strikes your neighborhood, bringing with it heavy winds, wind-driven rain, and hail big enough to damage roof shingles as well as metal roofs. Concerned about roof damage, you call a roofing professional and arrange for a free roof inspection. Your contractor and you discover considerable damage to your roof’s shingles and/or metal roofing panels. He or she gives you an estimate for a complete roof replacement since only replacing the broken shingles is inefficient.

2). You call your insurance carrier and file a roof damage insurance claim. The paperwork might be difficult, but you meticulously record any damage and respond to all queries.

3). Your insurance company sends an adjuster to check and assess the damage to your roof. he/she acknowledges that the damage is substantial in a variety of locations. Furthermore, he/she concurs with your roofer’s judgment that just fixing or replacing the damaged shingles would be ineffective. As a result, she authorizes funding for a complete roof replacement, including underlayment and flashing, among other things. Roof damage insurance claims seldom go as neatly as this. Most of the time, your insurance company’s adjuster will do everything in his or her power to approve the cheapest, most bare-minimum roof repairs. Furthermore, many forms of roof damage are not covered by homeowners insurance at all. That’s when public adjusters come in handy.

How Public Adjusters Aid in the Settlement of Roof Damage Claims

Having someone on your side is critical to getting your roof damage claim authorized for comprehensive roof repair services. When you engage a public adjuster, most will waive their charge if you utilize their favored roofing contractor. The rationale for this is that the public adjuster’s charge will be deducted from the contractor’s earnings for services rendered, which will be reimbursed by the insurance company. As a result, in virtually all cases, engaging a trained public adjuster costs a homeowner nothing.

Insurance companies have a vested interest in denying roof damage claims. Unfortunately, their first focus is not always taking care of their policyholders and repairing property losses to pre-loss state. The following is how a policyholder should handle a roof damage insurance claim, as well as what can happen in the best-case scenario.

Procedures for Filing and Obtaining Approval for Roof Repairs

1). A storm strikes your neighborhood, bringing with it heavy winds, wind-driven rain, and hail big enough to damage roof shingles as well as metal roofs. Concerned about roof damage, you call a roofing professional and arrange for a free roof inspection. Your contractor and you discover considerable damage to your roof’s shingles and/or metal roofing panels. He or she gives you an estimate for a complete roof replacement since only replacing the broken shingles is inefficient.

2). You call your insurance carrier and file a roof damage insurance claim. The paperwork might be difficult, but you meticulously record any damage and respond to all queries.

3). Your insurance company sends an adjuster to check and assess the damage to your roof. he/she acknowledges that the damage is substantial in a variety of locations. Furthermore, he/she concurs with your roofer’s judgment that just fixing or replacing the damaged shingles would be ineffective. As a result, she authorizes funding for a complete roof replacement, including underlayment and flashing, among other things. Roof damage insurance claims seldom go as neatly as this. Most of the time, your insurance company’s adjuster will do everything in his or her power to approve the cheapest, most bare-minimum roof repairs. Furthermore, many forms of roof damage are not covered by homeowners insurance at all. That’s when public adjusters come in handy.

How Public Adjusters Aid in the Settlement of Roof Damage Claims

Having someone on your side is critical to getting your roof damage claim authorized for comprehensive roof repair services. When you engage a public adjuster, most will waive their charge if you utilize their favored roofing contractor. The rationale for this is that the public adjuster’s charge will be deducted from the contractor’s earnings for services rendered, which will be reimbursed by the insurance company. As a result, in virtually all cases, engaging a trained public adjuster costs a homeowner nothing.

How Roof Damage Claim Procedure Works

Insurance companies have a vested interest in denying roof damage claims. Unfortunately, their first focus is not always taking care of their policyholders and repairing property losses to pre-loss state. The following is how a policyholder should handle a roof damage insurance claim, as well as what can happen in the best-case scenario.

Procedures for Filing and Obtaining Approval for Roof Repairs

1). A storm strikes your neighborhood, bringing with it heavy winds, wind-driven rain, and hail big enough to damage roof shingles as well as metal roofs. Concerned about roof damage, you call a roofing professional and arrange for a free roof inspection. Your contractor and you discover considerable damage to your roof’s shingles and/or metal roofing panels. He or she gives you an estimate for a complete roof replacement since only replacing the broken shingles is inefficient.

2). You call your insurance carrier and file a roof damage insurance claim. The paperwork might be difficult, but you meticulously record any damage and respond to all queries.

3). Your insurance company sends an adjuster to check and assess the damage to your roof. he/she acknowledges that the damage is substantial in a variety of locations. Furthermore, he/she concurs with your roofer’s judgment that just fixing or replacing the damaged shingles would be ineffective. As a result, she authorizes funding for a complete roof replacement, including underlayment and flashing, among other things. Roof damage insurance claims seldom go as neatly as this. Most of the time, your insurance company’s adjuster will do everything in his or her power to approve the cheapest, most bare-minimum roof repairs. Furthermore, many forms of roof damage are not covered by homeowners insurance at all. That’s when public adjusters come in handy.

How Public Adjusters Aid in the Settlement of Roof Damage Claims

Having someone on your side is critical to getting your roof damage claim authorized for comprehensive roof repair services. When you engage a public adjuster, most will waive their charge if you utilize their favored roofing contractor. The rationale for this is that the public adjuster’s charge will be deducted from the contractor’s earnings for services rendered, which will be reimbursed by the insurance company. As a result, in virtually all cases, engaging a trained public adjuster costs a homeowner nothing.

Insurance companies have a vested interest in denying roof damage claims. Unfortunately, their first focus is not always taking care of their policyholders and repairing property losses to pre-loss state. The following is how a policyholder should handle a roof damage insurance claim, as well as what can happen in the best-case scenario.

Procedures for Filing and Obtaining Approval for Roof Repairs

1). A storm strikes your neighborhood, bringing with it heavy winds, wind-driven rain, and hail big enough to damage roof shingles as well as metal roofs. Concerned about roof damage, you call a roofing professional and arrange for a free roof inspection. Your contractor and you discover considerable damage to your roof’s shingles and/or metal roofing panels. He or she gives you an estimate for a complete roof replacement since only replacing the broken shingles is inefficient.

2). You call your insurance carrier and file a roof damage insurance claim. The paperwork might be difficult, but you meticulously record any damage and respond to all queries.

3). Your insurance company sends an adjuster to check and assess the damage to your roof. he/she acknowledges that the damage is substantial in a variety of locations. Furthermore, he/she concurs with your roofer’s judgment that just fixing or replacing the damaged shingles would be ineffective. As a result, she authorizes funding for a complete roof replacement, including underlayment and flashing, among other things. Roof damage insurance claims seldom go as neatly as this. Most of the time, your insurance company’s adjuster will do everything in his or her power to approve the cheapest, most bare-minimum roof repairs. Furthermore, many forms of roof damage are not covered by homeowners insurance at all. That’s when public adjusters come in handy.

How Public Adjusters Aid in the Settlement of Roof Damage Claims

Having someone on your side is critical to getting your roof damage claim authorized for comprehensive roof repair services. When you engage a public adjuster, most will waive their charge if you utilize their favored roofing contractor. The rationale for this is that the public adjuster’s charge will be deducted from the contractor’s earnings for services rendered, which will be reimbursed by the insurance company. As a result, in virtually all cases, engaging a trained public adjuster costs a homeowner nothing.

Three Ways Public Adjusters Can Help You with Roof Damage Claims

1). In-depth examination and documenting of all roof damage

It is hard to have roof repairs authorized if you do not fully disclose the incident to your insurance carrier. Their adjusters will not seek more damage. A public adjuster will, and you will be guaranteed to disclose the entire degree of damage to your insurance carrier. As a result, you have a better chance of having all of your roof damage authorized.

2). Avoid the complexities and loopholes used by insurance companies to refuse claims

For example, if you notify your insurance provider that your roof is leaking and “water is pouring into the home,” you may be denied. The reason for this is that “flooding” is covered under different insurance. Simply using the incorrect wording might lead to roof damage claims being dismissed. Second, public adjusters and their partner roofing firms know when storms and hail strike your area, so they will have a “hail date” to record if your roof has hail damage. A public adjuster will cover all of your bases.

3). Making the most of your claim.

Public adjusters that specialize in roof damage claims are skilled at getting roofs authorized for complete replacements due to their insurance policy knowledge and expertise. They understand how to show that inexpensive bare-minimum repairs are often inadequate for restoring roof damage to pre-loss circumstances. When insurance companies disagree, a public adjuster may utilize legal processes and policy terms to dispute them.

Bottom Line

If you and your insurance carrier disagree on the degree of the damage and the level of repairs or roof replacement required, several actions must be done. These are often technical and need the skills of a skilled public adjuster. If you also want to hire a public adjuster to help settle your roof damage insurance claim, feel free to contact us and to help resolve the matter in your favor as soon as possible.

1). In-depth examination and documenting of all roof damage

It is hard to have roof repairs authorized if you do not fully disclose the incident to your insurance carrier. Their adjusters will not seek more damage. A public adjuster will, and you will be guaranteed to disclose the entire degree of damage to your insurance carrier. As a result, you have a better chance of having all of your roof damage authorized.

2). Avoid the complexities and loopholes used by insurance companies to refuse claims

For example, if you notify your insurance provider that your roof is leaking and “water is pouring into the home,” you may be denied. The reason for this is that “flooding” is covered under different insurance. Simply using the incorrect wording might lead to roof damage claims being dismissed. Second, public adjusters and their partner roofing firms know when storms and hail strike your area, so they will have a “hail date” to record if your roof has hail damage. A public adjuster will cover all of your bases.

3). Making the most of your claim.

Public adjusters that specialize in roof damage claims are skilled at getting roofs authorized for complete replacements due to their insurance policy knowledge and expertise. They understand how to show that inexpensive bare-minimum repairs are often inadequate for restoring roof damage to pre-loss circumstances. When insurance companies disagree, a public adjuster may utilize legal processes and policy terms to dispute them.

Bottom Line

If you and your insurance carrier disagree on the degree of the damage and the level of repairs or roof replacement required, several actions must be done. These are often technical and need the skills of a skilled public adjuster. If you also want to hire a public adjuster to help settle your roof damage insurance claim, feel free to contact us and to help resolve the matter in your favor as soon as possible.

RELATED ARTICLES

It’s that season

July 22, 2022

Why Did I Receive a Non-Renewal?

June 13, 2022

What Damages Does a Public Adjuster Handle?

April 11, 2022